How to save $100,000 on your next home

Published at | Updated at

When you’re planning to buy a home with a mortgage, it’s natural to focus on how much your monthly payment will be. After all, financial expert Dave Ramsey recommends you keep your payment at 25 percent or less of your monthly take-home pay.

As you’re browsing homes with your real estate pro, it’s also natural to be tempted to get a 30-year mortgage rather than a 15-year mortgage. An $800 monthly mortgage payment could buy you a $120,000 home on a 15-year mortgage, or a $185,000 home on a 30-year mortgage. That’s quite an upgrade in home!

But, while the difference in price is $65,000, you’ll end up paying way more than that over 30 years. Here’s the breakdown:

With a 15-year mortgage on a $120,000 home, you’ll pay a total of $145,350 — $25,350 of that is interest on the loan. With a 30-year mortgage on a $185,000 home, you’ll pay a total of $292,177 — $107,177 of that is interest. That’s twice as much total and more than four times the interest.

How to pay $100,000 more for the same home

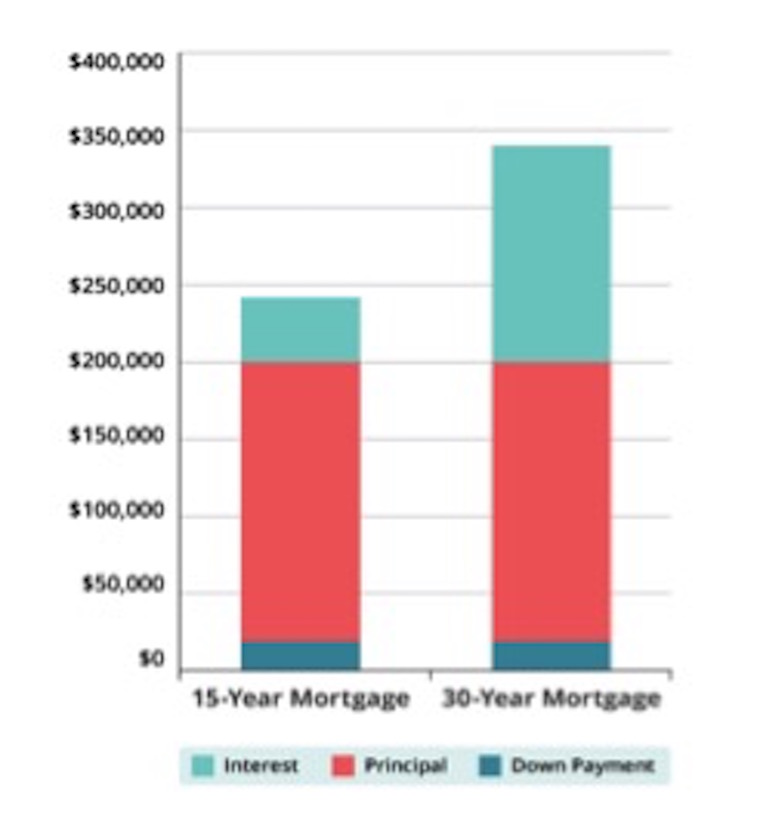

If that’s not enough to convince you that a shorter-term mortgage is worth it, let’s look at the numbers a different way. Instead of comparing two homes at two prices with the same payment, we’ll look at one $200,000 home with two different terms and payments.

With a 15-year mortgage, the payment on a $200,000 home is $1,330 a month. We’re assuming our homeowner made a 10 percent down payment, and got a 4 percent interest rate. The payment on the same home with a 30-year mortgage would be $860 a month, but 30-year mortgage rates are almost always higher than rates for 15-year mortgages. If we bump the interest rate up to 4.75 percent, and we all know that could happen, the payment jumps to $940 a month.

A $940 payment fits into most people’s budgets a lot easier than $1,330, but again, the extra interest you pay on a longer-term mortgage is mind-boggling. You’ll pay nearly $100,000 more for the same home with a 30-year mortgage than you would with a 15-year mortgage.

The wrong mortgage can cost you future opportunities

Clearly, a 30-year mortgage is much more expensive than a 15-year mortgage. But what about the opportunity cost of a longer-term loan? What could you do with an extra $100,000 and 15 more years of being debt-free?

Consider the impact of that money on your retirement plans. Once your 15-year mortgage is paid off, you could begin investing your $1,330 payment for retirement. Over the next 15 years, that would add nearly $560,000 to your nest egg. Let that money ride for five more years, and you’d have an extra million dollars for retirement!

Or maybe your retirement is in good shape once you’ve paid off the house and you’re completely debt-free, but now you’ve got a kid heading to college. Your payment would go a long way toward cash-flowing expenses that aren’t covered by scholarships, grants and part-time work.

Freeing up that money 15 years sooner provides plenty of opportunity to invest, travel, and give. Don’t let the temptation of a lower payment, or a bigger home, lure you into giving up those opportunities!

Used with permission from DaveRamsey.com. For help deciding which mortgage is right for you, visit https://www.daveramsey.com/mortgage-calculator.