D93 residents should see tax break after school board votes for temporary reduction

Published at | Updated at

IDAHO FALLS — Taxpayers in Bonneville Joint School District 93 will see a difference in their property taxes this year after the district voted last week to reduce total taxes.

On Wednesday, the District 93 school board held a special meeting where they voted to reduce the total taxes they will collect this year by $6 million.

According to a news release, last year, the board authorized the collection of $18.6 million in taxes; however, this year they voted to reduce that amount to $12.6 million.

In order to make it possible, the board will use funds from the district’s bond savings account to make this one-time reduction in property taxes.

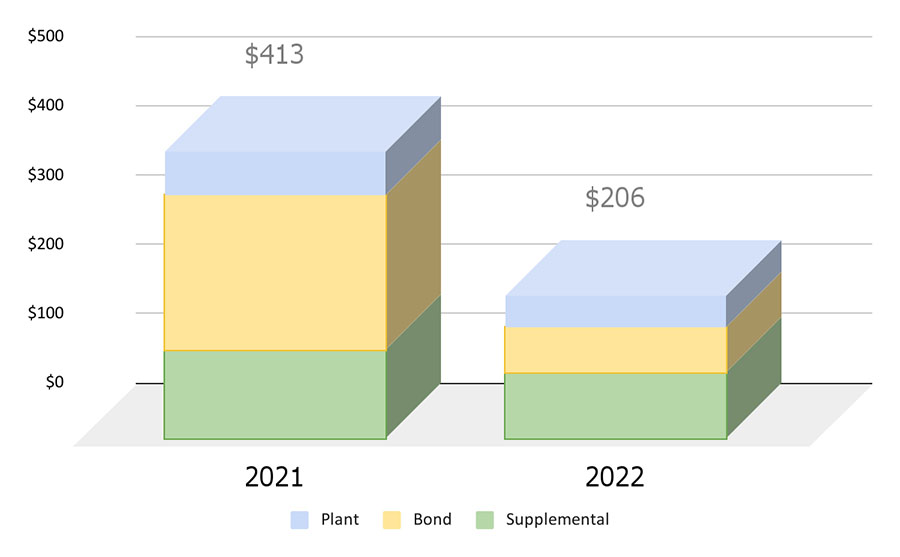

“I think this is a good decision by the board. They approved the supplemental levy for next year at $5.8 million which it has been for several years. Plant facility was approved for $2.8 million which is the same amount it has been and then last year the board levied $10 million in bond funds. This year, $4 million,” said Guy Wangsgard, chief financial officer for District 93. “So a significant reduction and that will work its way out to patrons through their assessment notices and their property taxes.”

District 93 superintendent Scott Woolstenhulme explained there would be a significant reduction in the total amount of taxes the district collects but how that impacts people on an individual basis is going to be completely determined by their own individual property assessments.

Next year, to make the required bond payments, the collection will most likely return to the normal $18.6 million annual collection amount.