Despite low unemployment rate, economists say local economy may be declining

Published at | Updated at

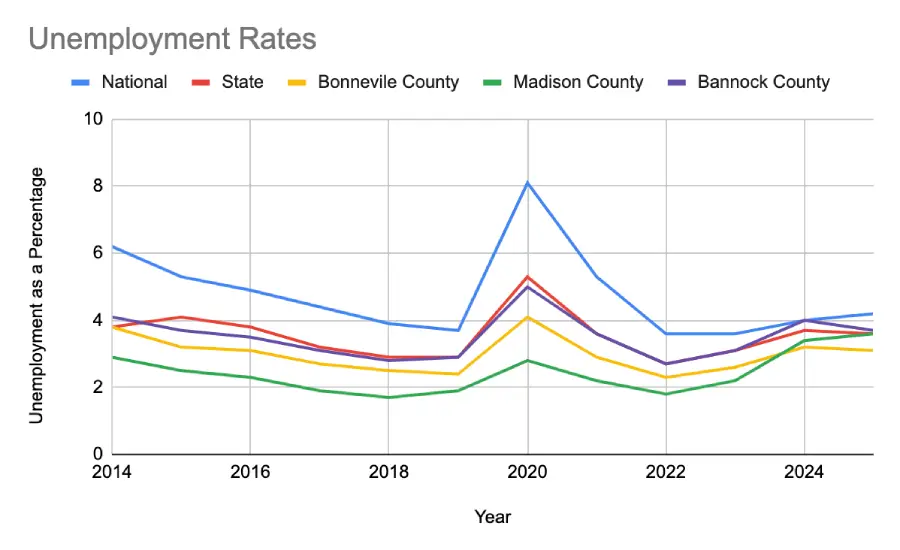

IDAHO FALLS — The state might have announced a 3.6% unemployment rate, but the way in which it declined, along with the high housing prices relative to income, may be indicative of a plateauing economy or one that may be beginning to decline.

Karl Geisler, the chairmain of Idaho State University’s Department of Finance and Economics, says decreasing unemployment rates aren’t always strictly positive. The way unemployment declines matters.

“Between January and May, there was a small drop (in the labor force) of only about 10 people in Bonneville county. There’s a larger drop in Bannock County — 40,067 (employed people) down to 39,978,” said Geisler.

Geisler says the drop in unemployment is a result of people giving up on the job search as a whole. People are outright leaving the labor force.

From May 2024 to May 2025, Bonneville County’s unemployment rate stayed at 3.1%, well below the state average, according to statistics from the Idaho Department of Labor. As of June, unemployment has risen slightly to 3.2%. During an Idaho Falls City Council meeting on July 8, members of the city’s finance department reported an unemployment rate of 4.2% — well above the county and state’s numbers.

Madison and Bannock Counties have fared similarly.

From May 2024 to May 2025, Madison County’s unemployment rate rose 0.4%, from 3.2% to 3.6%. It fell back to 3.4% in June. This makes Madison County’s unemployment rate lower than the state’s. If it follows recent trends, it may continue to decline.

Bannock County, on the other hand, saw a 0.3% decrease in unemployment in the same time period. It rose to 4.1% in June.

All of these unemployment rates (besides the city of Idaho Falls’) are lower than the national unemployment rate, which sits at 4.2%.

Income disparity

Looking at average incomes, the disparities between the counties becomes more pronounced.

The most recent data available from the Idaho Department of Labor was published in 2023. The data at the time showed Bonneville County was only one of the three counties to have a higher per capita income than the state’s per capita income.

The state’s per capita income was reported to be $59,385. Bonneville County beat that out with $60,032.

“Bonneville County has seen remarkable growth in the past few years,” said Brandon Duong, an economist with the Department of Labor. “One of its top industries for growth and employment is construction for this very reason. In addition to having strong health and education employment, Bonneville County has a large and high-paying business and financial services industry with employment of an estimated 8,000 employees. The county is just a great environment for business growth.”

At $50,084, Bannock County came in almost $10,000 short of the state average.

The difference between Bannock County’s per capita income and Bonneville County’s, according to Geisler, is due primarily to Bonneville County’s proximity to the Idaho National Laboratory. The student population at ISU is also a factor.

Madison County’s per capita income was less than half the state average, at $29,168.

Much of the disparities between Madison County and Bonneville and Bannock counties can be explained by the large population of students in Madison County.

More than 70% “of the Madison population are those who are currently enrolled (at Brigham Young University-Idaho). With a majority of people in the county being a student, income and per-capita wage data are likely to reflect this. Bannock County has a substantial student population but just 30.6% are currently enrolled,” said Duong.

Duong said Madison County also has a much larger proportion of young people, with 48.5% of its population between the ages of 18 and 24. In comparison, 10.4% of Bannock County and 8.7% of Bonneville County are in that age range.

“Madison County (is) a place where a lot of people are getting educated to start their career and don’t necessarily have the career advancement or capital that comes with age,” said Duong.

Home prices

Home prices in these three counties are relatively similar, but between the three counties, Bannock County appears to be the cheapest.

Average home prices in Bannock County were $422,500 in April 2025. Bonneville County comes in just behind that at $453,600. Madison County trails much further behind, with average home prices coming in at $516,000.

Bonneville and Bannock County home prices are lower than the state average, which Zillow reports to be around $473,400.

Madison County’s high housing costs have been a result of its growing population. The county can’t build homes quick enough to account for all the people coming and choosing to stay.

“There’s a lot of reasons why housing in Rexburg could be more expensive. Obviously, there is a housing price crisis in terms of affordability across the country. Idaho is no exception,” said Aaron Denny, economic development assistant for Rexburg’s Office of Economic Development and Public Affairs.

Denny spoke about Rexburg’s rapid growth since 2010, largely caused by students that come to Brigham Young University-Idaho and decide to stay there.

“Families of students and families that may have originally come for school, they’re staying, whereas before, students would come and go,” said Denny. “A lot of it comes to demand. When you add in the already high construction costs in the western United States, it’s hard to build homes.”

Overall, the most significant factor affecting eastern Idaho’s economy is unemployment. A decreasing unemployment rate is generally good, but not when it is the result of people just leaving the labor force altogether.

“Fewer people in the labor force means fewer people having jobs and having less income. It’s gonna mean less spending. For both Bonneville County and Bannock County, the total number of employed people dropped between January and May. That’s not a healthy sign for the labor market or the economy in general. It’s not like these are huge numbers … but it’s not healthy,” said Geisler

Geisler pointed out this trend in shrinking labor forces isn’t just seen locally. Statewide and even nationally, economists are seeing similar declines.

Economic impact on local food bank

The impacts of a plateauing or even a declining economy can be observed in organizations like the Community Food Basket of Idaho Falls. The organization has seen an increased need for its services. More people are in need of food and multiple families are living together to save on expenses.

Ariel Jackson, the food basket’s executive director, says there is also a substantial decrease in donations.

“Our donations have decreased by 200,000 pounds of food (since last year). These donations come from both grocery stores and local community food drive donations, as well as significant decreases in monetary donations,” said Jackson.

Amid the decline in donations, Jackson hopes they can keep pace with the increased demand for food and continue to help families in need.